Off-grid solar market in India set to take-off

The United Nations have launched “decade of energy access” vision to meet the “Sustainable Energy for All” initiative.

The Vision seeks to achieve by 2030, universal energy access to modern energy services, a doubling of the global improvement in energy efficiency and a doubling of the share of renewable energy in the global energy mix. This could mobilize billions of dollars of investment to address the challenge. To meet its energy needs, each country uses the energy available to it in differing proportions. This is what we call the energy mix.... various energy sources include crude oil, natural gas, coal, nuclear energy and the many sources of renewable energy.

The Vision seeks to achieve by 2030, universal energy access to modern energy services, a doubling of the global improvement in energy efficiency and a doubling of the share of renewable energy in the global energy mix. This could mobilize billions of dollars of investment to address the challenge. To meet its energy needs, each country uses the energy available to it in differing proportions. This is what we call the energy mix.... various energy sources include crude oil, natural gas, coal, nuclear energy and the many sources of renewable energy.

With over $2 billion annually, the off-grid market in India is large and ripe with business opportunity for investors.

The World Resources Institute estimates that in India, the off-grid energy access market includes 114 million households who are at the base of the pyramid (BOP) earning less than $2/day. Specifically, decentralized renewable energy enterprises (DRE) offer in India a market opportunity of $2.04 billion per year while the solar home lighting (SHS) market is estimated to be $27.4 million a year. The IEA estimates that the 400 million people without access to electricity in the country spend over $60 billion annually on energy (primarily inefficient and antiquated sources such as kerosene). This mean that even the poorest of the poor people are willing to pay for energy.

The World Resources Institute estimates that in India, the off-grid energy access market includes 114 million households who are at the base of the pyramid (BOP) earning less than $2/day. Specifically, decentralized renewable energy enterprises (DRE) offer in India a market opportunity of $2.04 billion per year while the solar home lighting (SHS) market is estimated to be $27.4 million a year. The IEA estimates that the 400 million people without access to electricity in the country spend over $60 billion annually on energy (primarily inefficient and antiquated sources such as kerosene). This mean that even the poorest of the poor people are willing to pay for energy.

Another way to frame the opportunity is this: assuming a peak demand of 1 kWh per household, if by 2020 the country will have 100 million households still without access to electricity, then there is a 100 GW opportunity to serve this market with off-grid energy.

It’s no wonder that according to the Off-Grid Business Indicator report released by the Solar Energy Foundation, India ranks highest among the top five off-grid markets in the world.

It’s no wonder that according to the Off-Grid Business Indicator report released by the Solar Energy Foundation, India ranks highest among the top five off-grid markets in the world.

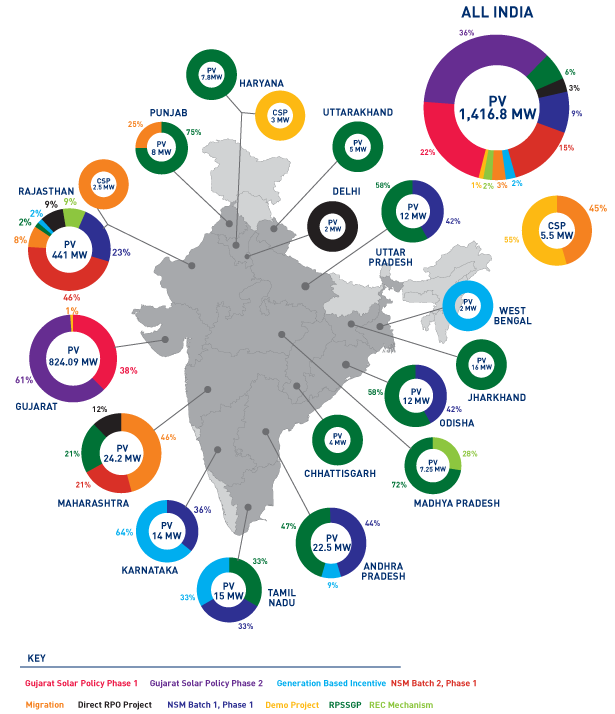

More MW produced than recorded.

To start with, it is unclear how many providers exist in the current market. Estimates diverge: 36 off-grid lighting companies are registered as channel partners with the government. Analysis conducted on the basis of extensive interviews by the Council on Energy Environment & Water (CEEW) has identified approximately 250 DRE lighting providers (218 of which focus on solar home lighting systems alone), both in the formal and informal market. Many of these providers are very new, with limited scale and their characteristics ill-understood. Many do not have detailed records of how many products they have sold over time and what percentage of products require servicing.

It can also be presumed that the Indian Government have no accurate records of the total amount of the small scale off grid residential Solar Panel installations done within the country till date. Thus the total installed MW is can be assumed to be far higher than those mentioned in the Governement records.

To start with, it is unclear how many providers exist in the current market. Estimates diverge: 36 off-grid lighting companies are registered as channel partners with the government. Analysis conducted on the basis of extensive interviews by the Council on Energy Environment & Water (CEEW) has identified approximately 250 DRE lighting providers (218 of which focus on solar home lighting systems alone), both in the formal and informal market. Many of these providers are very new, with limited scale and their characteristics ill-understood. Many do not have detailed records of how many products they have sold over time and what percentage of products require servicing.

It can also be presumed that the Indian Government have no accurate records of the total amount of the small scale off grid residential Solar Panel installations done within the country till date. Thus the total installed MW is can be assumed to be far higher than those mentioned in the Governement records.

Stop inverter and switch to Solar

All Inverter based power solutions are potential Solar Panel markets. This is because most of the villages have major hours of load shedding where during the day time and some time during the night the residents receive no electricity. The duration of this blackouts range from a minimum of 2 hours in some places to 8 hours. In Vasai to Virar and most of Maharashtra experience power cuts for the full day on Fridays. This is on the outskirts of a major city like Mumbai. The condition of people in the interior parts of the country are even worse.

Most of such places depend on batteries and inverters or even on Diesel Generators to get light and fans working. But the problem with this sort of arrangement is there is double consumption of power. When there is power cut the batteries power the lights and when the power comes back on they start to recharging from the grid power. Typically the battery is drained with 2 to 4 hrs depending upon the load and size of the battery and they require up to 8 to 10 hours of recharging. This way of energy transfer is kind of billing for 8 hours and providing for 2 hours is completely unfair on these users. The real time price difference is these residents might experience a 25% increase in their electricity bill.

But if these residents were to convert to solar power they would be completely independent from the grid and also get electricity 24 hours a day. And if they implement community residential grid the cost of power will also reduce.

All Inverter based power solutions are potential Solar Panel markets. This is because most of the villages have major hours of load shedding where during the day time and some time during the night the residents receive no electricity. The duration of this blackouts range from a minimum of 2 hours in some places to 8 hours. In Vasai to Virar and most of Maharashtra experience power cuts for the full day on Fridays. This is on the outskirts of a major city like Mumbai. The condition of people in the interior parts of the country are even worse.

Most of such places depend on batteries and inverters or even on Diesel Generators to get light and fans working. But the problem with this sort of arrangement is there is double consumption of power. When there is power cut the batteries power the lights and when the power comes back on they start to recharging from the grid power. Typically the battery is drained with 2 to 4 hrs depending upon the load and size of the battery and they require up to 8 to 10 hours of recharging. This way of energy transfer is kind of billing for 8 hours and providing for 2 hours is completely unfair on these users. The real time price difference is these residents might experience a 25% increase in their electricity bill.

But if these residents were to convert to solar power they would be completely independent from the grid and also get electricity 24 hours a day. And if they implement community residential grid the cost of power will also reduce.

Usage of Led lamps for lighting is paramount

LED lamps have lifespan and electrical efficiency that is several times better than incandescent lamps, and significantly better than most fluorescent lamps, with some chips able to emit more than 100 lumens per watt. The lamps have declined in cost to between US$13 as of 2014.

LED lamps have lifespan and electrical efficiency that is several times better than incandescent lamps, and significantly better than most fluorescent lamps, with some chips able to emit more than 100 lumens per watt. The lamps have declined in cost to between US$13 as of 2014.

These bulbs are more power-efficient than compact fluorescent bulbs and offer lifespans of 30,000 or more hours, reduced if operated at a higher temperature than specified. Incandescent bulbs have a typical life of 1,000 hours, and compact fluorescents about 8,000 hours. The lamps have declined in cost to between US$10 to $50 each as of 2012. These bulbs are more power-efficient than compact fluorescent bulbs and offer lifespan of 30,000 or more hours, reduced if operated at a higher temperature than specified. Incandescent bulbs have a typical life of 1,000 hours, and compact fluorescents about 8,000 hours.

Solar power for irrigation!

In the year 2008-2009 an experiment was carried out in Rajasthan where 14 Government Farms were tested with Solar Panels to irrigate the fields. This was practically replicated in the fields of 34 farmers in the years 2010-2011. Encouraged by this success in the year 2011-2012 about 1075 solar water pumps were installed in 14 districts of India's biggest State. Soon the demand started zooming up and the Government made provision in the state budget to install 4,500 water pumps. Based on this the Indian Government had planned to install 10,000 solar water pumps in the year 2012-2013.

In the year 2008-2009 an experiment was carried out in Rajasthan where 14 Government Farms were tested with Solar Panels to irrigate the fields. This was practically replicated in the fields of 34 farmers in the years 2010-2011. Encouraged by this success in the year 2011-2012 about 1075 solar water pumps were installed in 14 districts of India's biggest State. Soon the demand started zooming up and the Government made provision in the state budget to install 4,500 water pumps. Based on this the Indian Government had planned to install 10,000 solar water pumps in the year 2012-2013.

15W-T8-LED-Tube-Lights

15W-T8-LED-Tube-Lights

Led Tube Lights are manufactured in the exact shape and size of a normal Florescent Tube Light. This makes it easy to replace the existing Fluorescent tube light. These lamps are safe to use and will save you tons of money over the years.

Problems with Florescent Lamps

Fluorescent Lighting had a number of problems in the workplace and homes. These lights are being used in places where the light has to be switched on for several hours. These lights normally consume more power than LED if left on for several hours. On top of that the Florescent lamps are coated with mercury on the inside and in case these lamps breaks it could cause danger for not only the people but also for the environment around it.

Final Words

Going by what the industry has to say Maharashtra might emerge as the largest residential rooftop market owing to the high power tariffs and large demand. The next largest markets should be Tamil Nadu and Andhra Pradesh. Adoption could likely be fastest in Kerala, Delhi, Punjab, Goa, Tamil Nadu and Maharashtra.

India right now is in the initial stage most of the installation has been just to test the technology. The bigger tides are soon to follow and the pace will pick up quickly and soon the Indian residential market will be completely unstoppable and even overtake the Industrial markets.

Going by what the industry has to say Maharashtra might emerge as the largest residential rooftop market owing to the high power tariffs and large demand. The next largest markets should be Tamil Nadu and Andhra Pradesh. Adoption could likely be fastest in Kerala, Delhi, Punjab, Goa, Tamil Nadu and Maharashtra.

India right now is in the initial stage most of the installation has been just to test the technology. The bigger tides are soon to follow and the pace will pick up quickly and soon the Indian residential market will be completely unstoppable and even overtake the Industrial markets.