Dr Khasha Ghaffarzadeh, Research Director, IDTechEx

The drone market in recent years has completely changed character. Gone is the hype. IDTechEx's report clearly demonstrates this by tracking company investment and formation trends each year. The price wars have also taken their toll with the Chinese winner having forced many to give their hardware (platform) play completely. We are often therefore asked whether this marks the end of the drone opportunity or not?

We think not. Indeed, our report "Drones 2018-2038: Components, Technologies, Roadmaps, Market Forecasts" sees a plausible scenario in which the drone market (hardware and software) will reach some $33.5Bn by 2028, up from around $4.5Bn in 2017/18. Therefore, the journey is not yet at its finale. The question, however, is what opportunities will exist given the current difficult market condition?

Our report provides answers. It offers short-, medium-, and long-term forecasts segmented by 8 application areas and 12 components. It looks at technology and market evolution trends whilst analysing the key existing and emerging players. In this article we will also offer some insights from the hardware perspective. In subsequent articles, we will examine the software and business model perspectives.

The investment shows that companies have gone cool on hardware (full drone platform). This follows reason since the consumer platforms have been commoditized. Indeed, the winning design is now firmly in control of the prosumer segment too and is increasingly blurring the boundary between commercial and other segments. At best, rival suppliers hope to be the best number two or three, hoping that the value chain will wish to help them survive to break the monopolistic power of a single buyer (drone maker) and to allow them to hedge their bets should some unforeseen catastrophe befall the incumbent.

At first therefore it would seem that there is no opportunity left. Here, we try to argue that this notion is not correct. We will give our answer from the perspective of hardware components. In doing so, we will consider three major trends: (1) increased autonomy of navigation and task; (2) increased flight time and distance; and (3) increased size and power.

Towards Autonomy

Already drones have come a long way from the first generations that required manual remote control. Today, wayward or GPS-coordinate following is well established. See-and-avoid and see-identify-and-follow are also becoming commercial. Autonomous flight, however, is not yet commercial.

One reason is legislation that still requires drones to stay within the line (or the extended line) of sight. Here, the pilot must stand ready to intervene should drones fail. This externally-imposed limitation seems out of step with long-term technological capability. Indeed, as safety is improved and as societies become more accustomed to autonomous mobility in general, we expect regulators to loosen their grip. This is because without autonomous mobility the full benefits and productivity gains of drone use cannot be realized in many applications.

This evolution from manual remote control to autonomous beyond-line-of-sight (BLOS) navigation requires a suite or fusion of sensors. These will include sensors that see close and afar in day and night. As such, they may include ultrasound sensors (commonly used already), RGB cameras (commonly used already), radars, Lidars and so on. However, all these sensors will need to be drone compatible, meaning that they need to be lightweight, lower-power and low-cost with some built-in redundancies. As such, they represent ongoing opportunity for innovation and product development. In our report (http://www.idtechex.com/dronetech) we offer a detailed analysis of the evolution towards autonomous navigation, looking at how the sensor suite will evolve and assessing the different technology options. We also offer market forecasts segment by various sensor types.

It is worth noting here that the evolution of drone sensors will not just be limited to autonomous navigation. As drones become more specialized and move beyond just being a flying camera, more specialized task-specific and drone-compatible sensors will be required. These can include thermal sensors, multi or hyperspectral cameras, humidity and air quality sensors, and so on. The IDTechEx Research report also considers this trend, offering market forecasts and technology analysis.

Our report provides answers. It offers short-, medium-, and long-term forecasts segmented by 8 application areas and 12 components. It looks at technology and market evolution trends whilst analysing the key existing and emerging players. In this article we will also offer some insights from the hardware perspective. In subsequent articles, we will examine the software and business model perspectives.

The investment shows that companies have gone cool on hardware (full drone platform). This follows reason since the consumer platforms have been commoditized. Indeed, the winning design is now firmly in control of the prosumer segment too and is increasingly blurring the boundary between commercial and other segments. At best, rival suppliers hope to be the best number two or three, hoping that the value chain will wish to help them survive to break the monopolistic power of a single buyer (drone maker) and to allow them to hedge their bets should some unforeseen catastrophe befall the incumbent.

At first therefore it would seem that there is no opportunity left. Here, we try to argue that this notion is not correct. We will give our answer from the perspective of hardware components. In doing so, we will consider three major trends: (1) increased autonomy of navigation and task; (2) increased flight time and distance; and (3) increased size and power.

Towards Autonomy

Already drones have come a long way from the first generations that required manual remote control. Today, wayward or GPS-coordinate following is well established. See-and-avoid and see-identify-and-follow are also becoming commercial. Autonomous flight, however, is not yet commercial.

One reason is legislation that still requires drones to stay within the line (or the extended line) of sight. Here, the pilot must stand ready to intervene should drones fail. This externally-imposed limitation seems out of step with long-term technological capability. Indeed, as safety is improved and as societies become more accustomed to autonomous mobility in general, we expect regulators to loosen their grip. This is because without autonomous mobility the full benefits and productivity gains of drone use cannot be realized in many applications.

This evolution from manual remote control to autonomous beyond-line-of-sight (BLOS) navigation requires a suite or fusion of sensors. These will include sensors that see close and afar in day and night. As such, they may include ultrasound sensors (commonly used already), RGB cameras (commonly used already), radars, Lidars and so on. However, all these sensors will need to be drone compatible, meaning that they need to be lightweight, lower-power and low-cost with some built-in redundancies. As such, they represent ongoing opportunity for innovation and product development. In our report (http://www.idtechex.com/dronetech) we offer a detailed analysis of the evolution towards autonomous navigation, looking at how the sensor suite will evolve and assessing the different technology options. We also offer market forecasts segment by various sensor types.

It is worth noting here that the evolution of drone sensors will not just be limited to autonomous navigation. As drones become more specialized and move beyond just being a flying camera, more specialized task-specific and drone-compatible sensors will be required. These can include thermal sensors, multi or hyperspectral cameras, humidity and air quality sensors, and so on. The IDTechEx Research report also considers this trend, offering market forecasts and technology analysis.

Towards increasing flight time

Drones today offer limited flight time. The energy storage is the primary constraint. This limits flight distance and reduces drone productivity since charging time will increase drone downtime. It also places severe limits on the drone's payload carrying capability.

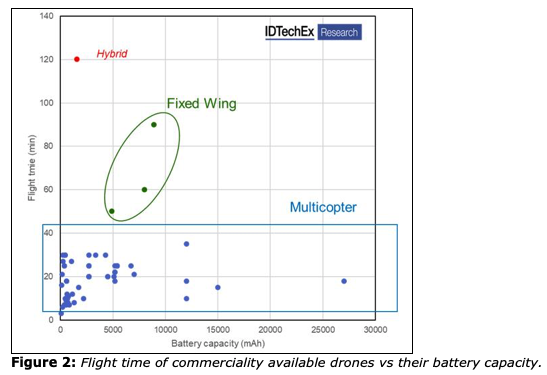

Figure 2 maps flight time (in min) vs battery capacity (in mAh). Here, each point represents the performance of a commercial drone on the market. It is evident that fixed wings offer superior flight time and distance compared to multicopters. The latter however offers a more stable and controllable flight. This difference in fact sets the basis upon which these two drone designs differentiate their applications, e.g., fixed wings still used in large field scouting.

Interestingly, it appears that in multicopters the additional battery capacity is not used to extend flight time but to improve payload carrying capability. This consideration will change as autonomous or BLOS flight becomes viable.

The dominant battery chemistry in commercially available drones is Li polymer. However, new approaches are emerging. Many chemistries such as Lis have been demonstrated, although fuel cell appears particularly suited to drone applications. In general, the energy source for drone will remain an area of opportunity. Improvement here will be essential to render larger-sized and/or autonomous drones possible. To learn about emerging opportunities in the drone business read our report Drones 2018-2038: Components, Technologies, Roadmaps, Market Forecasts .

In conclusion, drones are always evolving. In particular, they are becoming larger, heavier and more autonomous. This will open numerous new applications in time and will represent a growing opportunity for drone companies as well as for many in the value chain including those focused on various sensors, light weight body materials, electric motors, speed control circuits, energy storage, and so on. Our report "Drones 2018-2038: Components, Technologies, Roadmaps, Market Forecasts" uniquely provides short-, medium- and long-term market forecasts segmented by 8 applications and 12 components. It considers how drone applications as well as components are likely to evolve, thus highlighting numerous emerging opportunities. It also offers a comprehensive analysis of the current state of the industry, offering a detailed look at products, technologies and players.

Drones today offer limited flight time. The energy storage is the primary constraint. This limits flight distance and reduces drone productivity since charging time will increase drone downtime. It also places severe limits on the drone's payload carrying capability.

Figure 2 maps flight time (in min) vs battery capacity (in mAh). Here, each point represents the performance of a commercial drone on the market. It is evident that fixed wings offer superior flight time and distance compared to multicopters. The latter however offers a more stable and controllable flight. This difference in fact sets the basis upon which these two drone designs differentiate their applications, e.g., fixed wings still used in large field scouting.

Interestingly, it appears that in multicopters the additional battery capacity is not used to extend flight time but to improve payload carrying capability. This consideration will change as autonomous or BLOS flight becomes viable.

The dominant battery chemistry in commercially available drones is Li polymer. However, new approaches are emerging. Many chemistries such as Lis have been demonstrated, although fuel cell appears particularly suited to drone applications. In general, the energy source for drone will remain an area of opportunity. Improvement here will be essential to render larger-sized and/or autonomous drones possible. To learn about emerging opportunities in the drone business read our report Drones 2018-2038: Components, Technologies, Roadmaps, Market Forecasts .

In conclusion, drones are always evolving. In particular, they are becoming larger, heavier and more autonomous. This will open numerous new applications in time and will represent a growing opportunity for drone companies as well as for many in the value chain including those focused on various sensors, light weight body materials, electric motors, speed control circuits, energy storage, and so on. Our report "Drones 2018-2038: Components, Technologies, Roadmaps, Market Forecasts" uniquely provides short-, medium- and long-term market forecasts segmented by 8 applications and 12 components. It considers how drone applications as well as components are likely to evolve, thus highlighting numerous emerging opportunities. It also offers a comprehensive analysis of the current state of the industry, offering a detailed look at products, technologies and players.

NOTE

This writeup by IDTechEx was sent to PluginIndia. We felt since drones too rely on batteries and electric motor, we felt this could be an appropriate article for PluginIndia. Please comment if you are interested in more such articles.

IDTechEx conducts detailed examinations of emerging technologies, which are delivered through their Market Research Reports and Subscription services.

Read more at: https://www.idtechex.com

This writeup by IDTechEx was sent to PluginIndia. We felt since drones too rely on batteries and electric motor, we felt this could be an appropriate article for PluginIndia. Please comment if you are interested in more such articles.

IDTechEx conducts detailed examinations of emerging technologies, which are delivered through their Market Research Reports and Subscription services.

Read more at: https://www.idtechex.com

Further Reading

The Drones Are Coming, The Drones Are Coming!

The Drones Are Coming, The Drones Are Coming!