| By Kamlesh Mallick with inputs from Industry |

While the EV community is aghast, that private electric cars are excluded from the scheme, there were more important questions regarding battery manufacturing that needed answering and even those have been answered.

In this blog, we talk about the FAME 2 scheme and also look at mandates for local battery pack, components and cell manufacturing in India.

In order to promote manufacturing of electric vehicle technology and to ensure sustainable growth of the same, the Department of Heavy Industry implemented the FAME-India Scheme Phase-I [Faster Adoption and Manufacturing of Electric Vehicles in India] from 1st April 2015. The scheme, which was initially upto 31st April 2017, and it had been extended upto 31st March, 2019.

The salient features of Phase-II of the FAME India Scheme, called the FAME 2, was announced in first week of March 2019, which proposes to give a push to electric vehicles (EVs) in public transport and seeks to encourage adoption of EV's by way of market creation and demand aggregation.

The Total outlay of for FAME 1, was around 795 Crore to Rs. 895 Crore and the total fund requirement for FAME 2 is Rs 10,000 Crore over three years from 2019-20 to 2021-22 supporting 10 Lakh electric 2 wheelers, 5 Lakh 3 wheelers, 55,000 commercial/fleet electric cars and 7000 Electric Buses.

The objectives are to

- Create Demand for EV’s by offering incentives

- Create EV charging infrastructure

- Have special emphasis for public transport, especially Electric Buses

- 3 Wheeler and 4 Wheeler, incentives will only be applicable for commercial purposes

- 2 Wheeler segment will have focus for private vehicles

- 2700 charging station in metros in the next 3 years

- Establishment of charging stations in major highways

Our view is that it does not make a difference anyway. We have observed over the years Internal Combustion Engine based manufacturers have been inflating the price of electric cars.

This has resulted in fairly low volumes sold, as there is less demand for Electric Cars. The ICE manufacturers will continue operating in this mode, even after FAME 2 is implemented.

Our only worry is this might dent the confidence of honest electric car startups, who want to launch affordable Electric Cars.

We spoke to a CEO of an electric car startup company. He wished to remain anonymous and said the following -

“As far as my views on FAME 2 as CEO are, currently we are in a little precarious situation as the ruling is very clear on private owners of 2W getting subsidy and 4W owners not getting any. Our overall broad view has always been that we do not want to design a product with subsidy in mind. We are watching this space very closely and waiting for information.

My personal view is that; FAME 2 is well intentioned and given that India cannot be China and subsidize a whole EV industry, the steps are in the right direction with clear goal of cutting oil imports as much as possible. Could India have done better? We could, but India has a 100 other problems to deal with too. India is counting on its innovators and dreamers to drive the change rather than throw money at the problem.

As EV community, we should whole heartedly, support new ideas and solutions which will encourage more people to join in.”

The details of the FAME 2 scheme are still being worked out and they hope to have it ready by April 2019, we still have questions that need answering.

Offering demand side incentives is fantastic, but we feel that there has to be a clear policy in the following

- Mention the structure of how the incentives will be distributed. Currently there is no incentive for the manufacturer to keep the sticker price of EV’s low. We have observed many manufacturers artificially inflate the price of an EV to ensure high margins in spite of the subsidy.

- What if the scheme expires in 2023 and is not renewed? What is the scheme is pulled due to various reasons? Will this affect the EV industry?

- What supply side incentives are provided to make Lithium Cells in India? Assume the industry sells 10 Lakh, two wheelers by 2023, each with an average battery capacity of 2 kWh. That would mean around 20 Lakh kWh worth of battery packs would have to be imported only for two wheelers. If by 2023, not even a single kWh is made in India, how will it affect the industry in 2023?

- There are many companies importing cells from China and manufacturing battery packs, but unless cells are themselves made in India, it will lead to the same situation that occured in 2012.

Back in 2010, the then UPA government launched the MNRE scheme which offered incentives for consumers for EV’s. Due to the introduction of the policy, EV industry saw 200 per cent growth in its sales. The organised players saw a huge growth in the market share.

But on March 31, 2012, the MNRE scheme was withdrawn which resulted in over 70 per cent fall in EV sales. Manufacturers faced closure of dealerships, with around 250 dealers having closed their operations within 3 months of the announcement.

This horrific scenario should never be allowed to happen. By 2023, the industry must continue to thrive without government schemes or support.

The government seems to have answered this crucial answer of battery manufacturing too, by creating the National Mission on Transformative Mobility and Storage to encourage drive clean, connected, shared, sustainable and holistic mobility initiatives.

The scheme encourages the following

- Phased Manufacturing Programme (PMP) valid for 5 years till 2024 to support setting up of a few large-scale, export-competitive integrated batteries and cell-manufacturing Giga plants in India.

- A phased roadmap to implement battery manufacturing at Giga-scale will be considered with initial focus on large-scale module and pack assembly plants by 2019-20, followed by integrated cell manufacturing by 2021-22.

- Each phase of localisation will be finalised by the Mission with a clear Make in India strategy for the electric vehicle components as well as battery.

FAME 2 is a step in the right direction. But there are shortcomings. You have pointed out some. I will add:

- The incentives based on size of battery is misplaced. This means a more efficient vehicle, which uses smaller battery, gets less incentivised.

- It is not clear what will happen when Swapping batteries, an important step recognised by most, is used.

- Charging station subsidy: there is no attempt to define the business case for charging station. Subsidy is to bridge gap. What is the gap? For what kind of chargers? Will we set up chargers with no vehicles to use them

The proposed subsidy would be based on the battery capacity and that is Rs 10,000 per kWh

- So a Mahindra e2o Plus with 11 kWh will get Rs 1,10,000 subsidy

- A Hyundai Kona with say a 25 kWh battery pack will get Rs 2,50,000 subsidy

- An Okinawa iPraise electric scooter with a 2.9 kWh will get Rs 29,000 subsidy

On one hand, incentives based on battery pack size is a good idea. For example, this would encourage two wheeler manufacturers, add large battery packs for extended range, thus matching performance and range levels of ICE scooters.

But at the same time an Electric scooter say with a 1.4 kWh lithium battery pack under FAME 1 got around Rs 22,000 subsidy and now only will get Rs 14,000.

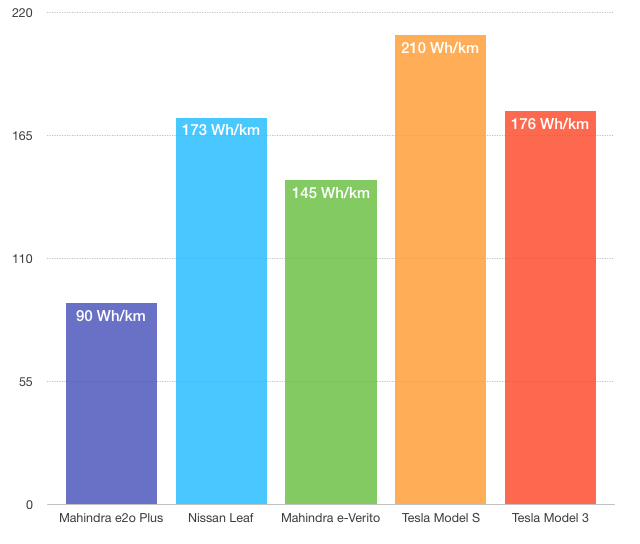

Also as Prof. Jhunjhunwala pointed out, there is less support for small electric cars that offer superior efficiency, as shown in the chart, which compares Indian Electric cars vs Global Electric Cars.

The EV industry needs to be self sustaining pretty soon. Any withdrawal of incentives should not affect the industry like it did in 2012. The focus should be manufacturing Lithium cells and achieve a steady demand for EV’s over a long period of time.

We congratulate the government for launching FAME 2 and National Mission on Transformative Mobility and Storage. This shows strong commitment towards electric mobility and refutes theories from people who say the government is not doing anything for EV’s.

We hope to do a part 2 episode once we have more details of the FAME 2 scheme

Finally, we thank Mr Rajit A. R. Arya, CEO of ARTEM for sharing his views on this.

Stay tuned!