The organization released a report that establishes a vision for the future of India’s mobility system and also defines a change model to support rapid scaling and deployment of solutions.

- Currently non-motorized transportation (i.e., walking and biking) and public transportation represent a large share of all trips taken in India (roughly 66% in 2007). This is in stark contrast to a meager 10% in the United States. Preserving this mode share through improved urban design can make walking, biking, and public transport safe

and desirable in India. - Auto ownership in India remains low, with only 18 cars per 1,000 citizens (China has nearly 69, while the U.S. has 786 cars).6 The scarcity of privately owned

four-wheel vehicles and a large number of two-wheelers creates opportunities for India to deploy emerging technology and business models to make mobility services more convenient and cost-effective - India has a growing portfolio of programmes supporting a mobility leapfrog - Make in India , Digital India, FAME, Green Mobility Fund (80,000 CR) etc.

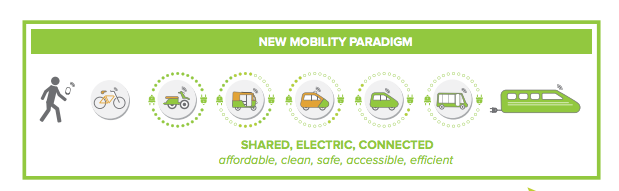

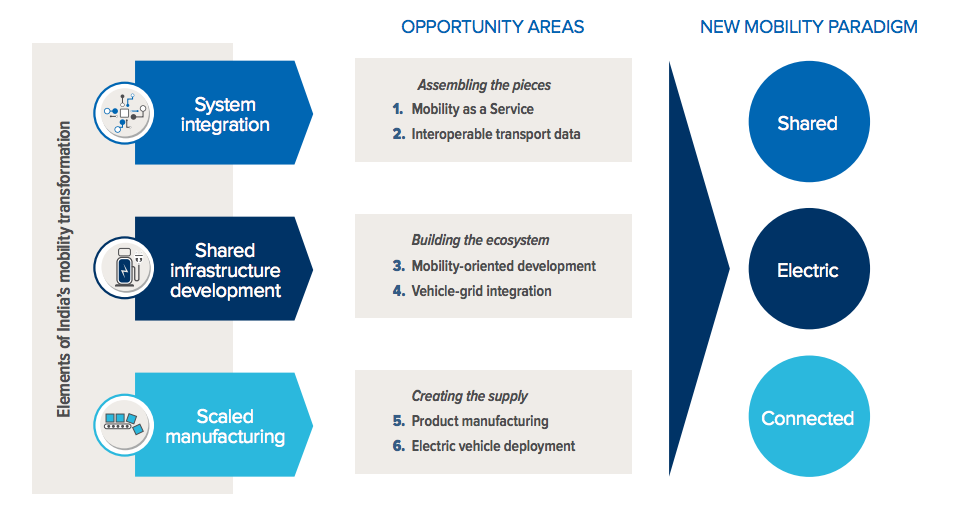

| A THREE-PHASED APPROACH TO CHANGE

|

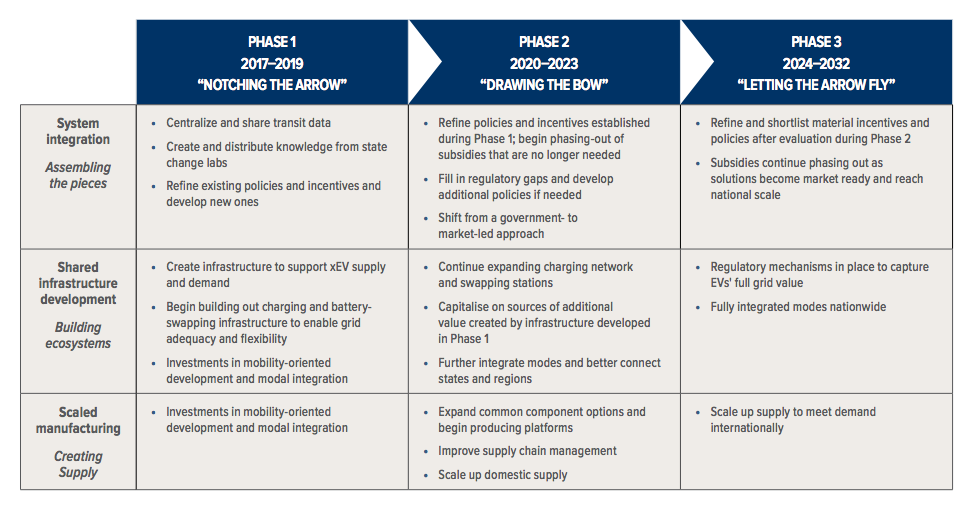

- A single entity responsible for strategic planning and implementation, empowered with financial and evaluative capabilities, can accelerate mobility-oriented development

- City governments could combine transit, transport, and land use agencies into integrated Metropolitan Planning Councils (MPCs) designing to address all modes of transit, from walking to biking.

- A well-designed feebate (a system of charges and rebates whereby energy-efficient or environmentally friendly practices are rewarded while failure to adhere to such practices is penalized.) programme can steer buyers towards ‘clean-fuel’ vehicles, encourage manufactures to incorporate low-emissions technology, and retire inefficient vehicles.

- Launch a national-level feebate programme for light-duty vehicles to complement, not compete with current standards

- ZEV credit programmes could help scale electric vehicle manufacturing across india.

- ZEV credits represent an important incentive category—supply-side incentives—that could be strengthened in India, and are customizable to meet specific states’ policy

objectives, which could work well with India’s governance style. - While Tesla, as a manufacturer of BEVs only, is not subject to ZEV mandates, it earns ZEV credits, which it can sell to other automakers seeking to meet compliance

levels; in Q2 2016, Tesla sold a portion of its ZEV credits and earned Rs 9.2 crore in revenue, helping the company post profits that quarter. Indian automakers could benefit from this new revenue source.

- ZEV credits represent an important incentive category—supply-side incentives—that could be strengthened in India, and are customizable to meet specific states’ policy

- Shared vehicles could electrify 1 trillion passenger-kilometres by 2020

- A package of smart policies could disincentivize privately owned ICE vehicles and promote shared EVs in India, electrifying more passenger-kilometres sooner while providing higher-quality and greater access to mobility services.

- Electrifying 1 lakh crore passenger-kilometres could save about 20% of India’s 3,300 lakh BTUs of annual transportation energy consumption—saving several hundred

Rs crore in fuel cost and several crore metric tonnes of CO2. - Offer shared and fleet EVs lower interest rates, VATs, registration taxes, and electricity tariffs compared to privately owned EVs and ICEs.

- Regulations that enable EVSE (Electric Vehicle Supply Unit) deployment.

- Regulatory frameworks could classify EVs, charging infrastructure, and battery swapping facilities as distributed energy resources, and aim to monetize various value streams from EVs—for example, provision of demand response, oil use reduction, etc.

- Regulatory frameworks could classify EVs, charging infrastructure, and battery swapping facilities as distributed energy resources, and aim to monetize various value streams from EVs—for example, provision of demand response, oil use reduction, etc.

- Without the requisite demand and a common platform to share knowledge and resources, manufacturing electric vehicles in india will continue to scale slowly

- Decrease risk for manufacturers by incentivizing EVs for most fleet operations in cities; this could be achieved through a supportive policy environment and promulgation

of innovative business models. - Establish a manufacturing consortium to develop a battery and scale production.

- Decrease risk for manufacturers by incentivizing EVs for most fleet operations in cities; this could be achieved through a supportive policy environment and promulgation

- The right stack of fiscal incentives across all levels of government could rapidly accelerate EV adoption in India, possibly at a faster pace than Norway has observed, considering India’s scale and experience with fast transformation.

- The central government may not have to extend FAME demand incentives beyond 2025, as many forecasts project that declining battery prices and manufacturing costs will erase EV cost premiums in a matter of years, potentially saving the Government of India several years of subsidies

- The central government may not have to extend FAME demand incentives beyond 2025, as many forecasts project that declining battery prices and manufacturing costs will erase EV cost premiums in a matter of years, potentially saving the Government of India several years of subsidies

- 2- and 3-wheelers constitute ~80% of India’s domestic automobile sales and ~20% of India’s national mode share, offering a huge market that is almost ripe for electrification

- Standardized, smart, swappable batteries for 2- and 3-wheelers with lease and/or pay-per-use business models, an extensive swapping-station network, and an integrated payment and tracking system could rapidly electrify personal and intermediary public transit by cutting sticker prices by as much as 70%

- Policy changes to ease tax burdens (under new GST) related to battery swapping, buying and selling energy for EVSE providers, and buying batteries without vehicles (India’s current tax structure makes buying batteries without the vehicles costlier than batteries for the EVs)

- Identify a domestic manufacturing plant to develop modular batteries with a standard form factor for sale to OEMs with compatible 2- and 3-wheelers

- Build swapping stations managed privately or jointly by utilities, DISCOMS, and OEMs; offer preferential electricity tariffs

- Standardized, smart, swappable batteries for 2- and 3-wheelers with lease and/or pay-per-use business models, an extensive swapping-station network, and an integrated payment and tracking system could rapidly electrify personal and intermediary public transit by cutting sticker prices by as much as 70%

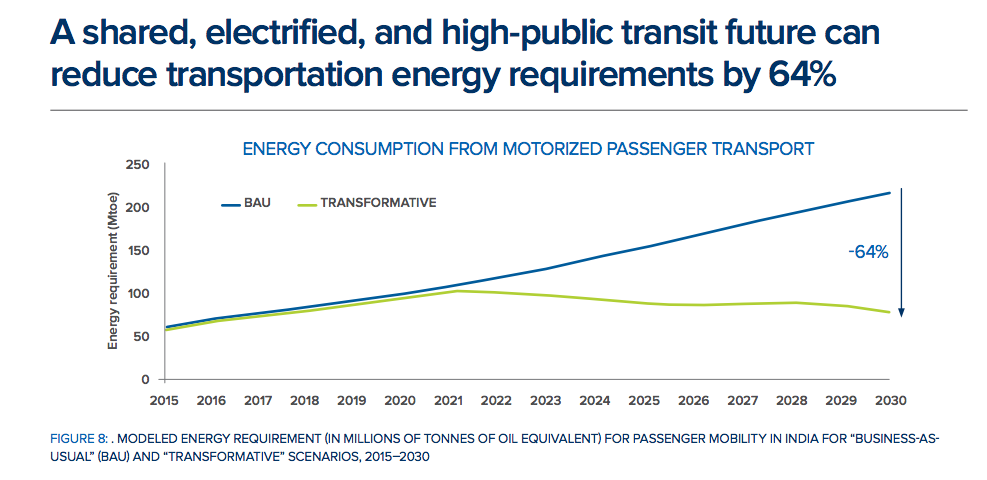

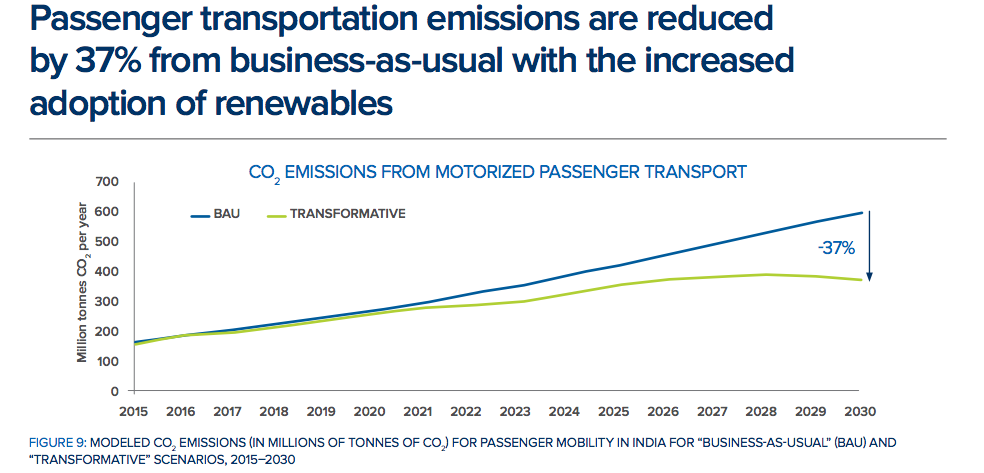

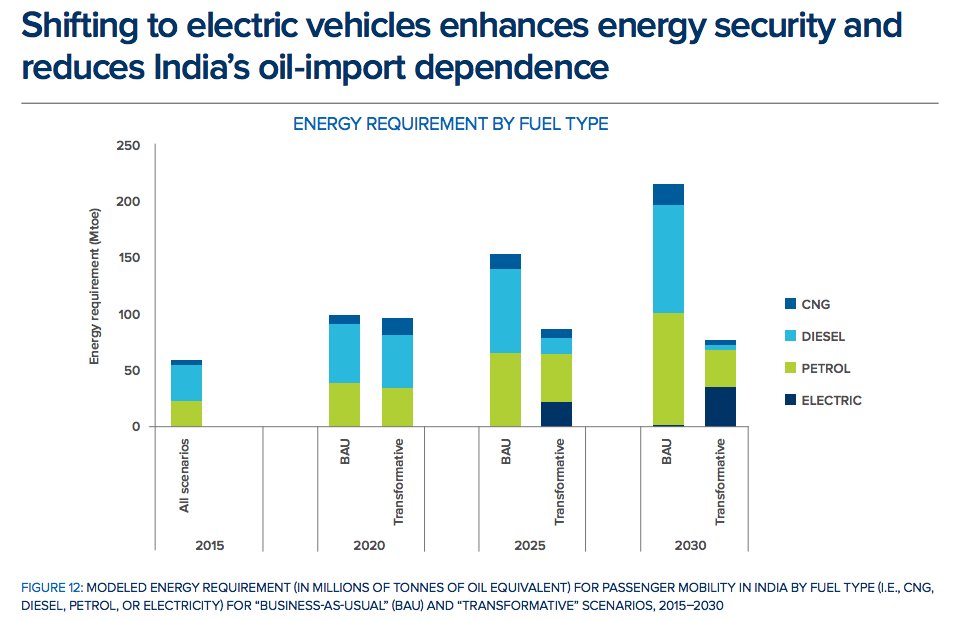

Impact of the transformation

This is an incredible report by NITI Aayog, created by remarkable and intelligent team of people. We have the data, we have actionable items, we have support from the government. Now is the time to make the change. Our dream of breathing clean air in our cities is getting real.

Read the full report

INDIA LEAPS AHEAD: TRANSFORMATIVE MOBILITY SOLUTIONS FOR ALL