By Kamlesh Mallick with inputs from industry

So the 2019 budget was presented by our finance minister Nirmala Sitharaman and electric mobility was the major winner.

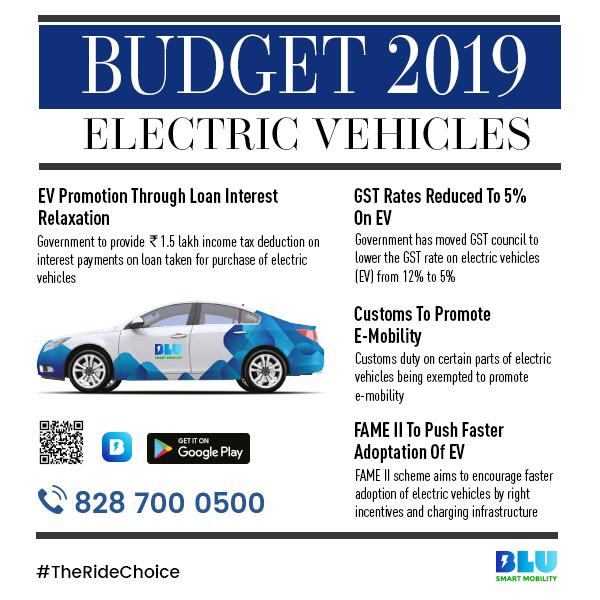

There are income tax breaks for consumers, there are lower import duties on components for manufacturers and less GST than before.

All this shows the commitment of our government towards green mobility in India.

There are income tax breaks for consumers, there are lower import duties on components for manufacturers and less GST than before.

All this shows the commitment of our government towards green mobility in India.

After announcing the FAME 2 policies in May this year, the annual budget enhanced the support for electric mobility.

Here are the key highlights

Here are the key highlights

- Government will provide additional income tax deduction of Rs 1.5 lakhs on interest paid on loans taken to purchase electric vehicles.

This amounts to a benefit of Rs 2.5 Lakhs to consumers who take loan to buy EV's - Import duty is removed on parts for electric vehicles such as drivetrains, onboard charger, compressor, charging cables etc.

- To encourage investment in new tech areas like lithium ion battery manufacturing, charging infrastructure etc, the government will provide investment linked income tax exemptions.

- Proposal to GST council to reduce GST from the current 18% to 5% for EV's.

Income tax deduction on EV loans

Let's look at a use case. Assume you want to take a loan on an electric scooter say Hero Photon which might cost Rs 1,00,000.

Let's assume, you take a loan Rs 80,000. Assuming interest of 13%, the interest paid per annum will be Rs 10,400 for 3 years.

This means Rs 3,466 per year. Tax benefit will be 30% of Rs 3,466 - Assuming you fall in 30% income tax bracket.

Let's take an electric car use case.

Assume you want to take a loan on an electric car say Tata Tigor which might cost around Rs 12,50,000.

Let's assume, you take a loan Rs 8,00,000. Assuming interest of 10%, the interest paid per annum will be Rs 80,000 for 5 years.

This means Rs 16,000 per year. Tax benefit will be 30% of Rs 16,000 - Assuming you fall in 30% income tax bracket.

This does not seem much. But still is a benefit.

GST reduction

There is a proposal to the GST council to lower the GST rate on electric vehicles from 12$% to 5%

This would be a huge benefit for EV manufacturers. Although it is to be noted that the GST council has to yet agree to this proposal.

So this will take some time.

Import Duty on components

Drivetrains, onboard charger, compressor, charging cables and other electronic components are imported by many manufacturers.

Reducing the duties will give some temporary relief, but it would be better if manufacturers create these components in India.

Let's look at a use case. Assume you want to take a loan on an electric scooter say Hero Photon which might cost Rs 1,00,000.

Let's assume, you take a loan Rs 80,000. Assuming interest of 13%, the interest paid per annum will be Rs 10,400 for 3 years.

This means Rs 3,466 per year. Tax benefit will be 30% of Rs 3,466 - Assuming you fall in 30% income tax bracket.

Let's take an electric car use case.

Assume you want to take a loan on an electric car say Tata Tigor which might cost around Rs 12,50,000.

Let's assume, you take a loan Rs 8,00,000. Assuming interest of 10%, the interest paid per annum will be Rs 80,000 for 5 years.

This means Rs 16,000 per year. Tax benefit will be 30% of Rs 16,000 - Assuming you fall in 30% income tax bracket.

This does not seem much. But still is a benefit.

GST reduction

There is a proposal to the GST council to lower the GST rate on electric vehicles from 12$% to 5%

This would be a huge benefit for EV manufacturers. Although it is to be noted that the GST council has to yet agree to this proposal.

So this will take some time.

Import Duty on components

Drivetrains, onboard charger, compressor, charging cables and other electronic components are imported by many manufacturers.

Reducing the duties will give some temporary relief, but it would be better if manufacturers create these components in India.

| What the industry saying? "This is a milestone budget for electrics... We will consider investments" - Manish Sharma, CEO of Indian operations of Panasonic "Additional income tax reduction is a major boost for end-consumers to purchase EV's" - Tarun Mehta, Co-founder and CEO of Ather Energy "To make India as an EV manufacturing hub, decision on incentivizing EV manufacturing by extending benefits under Section 35AD(1) is a move in the right direction. It will help in the creation of a local manufacturing base and encourage component manufacturers to invest in the sector" - Sohinder Gill, Society of Manufacturers of Electric Vehicles "One good thing is removing import duty on components, the positive impact is that the costs will come down, while startups who are creating their own electronic components will get impacted, you will see sub standard components coming to India." - Manish Agrawal, Founder of ZeroBill.in |

Let us know your thoughts on the 2019 Indian budget's impact on EV's.